United States Federal Credit Union

As one of the nation’s most trusted financial institutions, our story is built on a century of excellence, integrity, and a forward-thinking approach to managing wealth.

About Us

At the core of USFCU is a leadership team composed of industry veterans, financial experts, and visionary innovators. Our Board of Directors and executive management are dedicated to upholding the highest standards of corporate governance, ensuring that every decision is made with our clients’ best interests in mind.

We believe in a culture of transparency, accountability, and collaborative decision-making. Our leadership is not only responsible for steering the strategic direction of the bank but also for nurturing the values that have defined us for generations. From our day-to-day operations to long-term planning, every facet of our work is guided by a commitment to ethical practices, robust risk management, and an unwavering focus on client service.

Our Core Values and Philosophy

Our operating philosophy is simple: every client deserves bespoke financial solutions, delivered with integrity and precision. These principles underpin every aspect of our business:

- Client-Centric Approach: We build lasting relationships by understanding each client’s unique financial needs and aspirations.

- Ethical Stewardship: Every transaction, strategy, and recommendation is guided by our commitment to fairness, transparency, and ethical behavior.

- Innovation in Service: Embracing modern technology and forward-thinking strategies allows us to offer solutions that are both innovative and practical.

- Sustainable Growth: We focus on creating long-term value—both for our clients and for the communities we serve—by integrating sustainable practices into our business model.

Private Banking & Wealth Management

Our private banking services are tailored to high-net-worth individuals and families who demand a level of service that is both personal and unparalleled. We offer:

- Bespoke Wealth Management: Customized investment strategies developed by our seasoned advisors.

- Asset Protection & Estate Planning: Strategies to safeguard your legacy for future generations.

- Tax Optimization: Expert guidance designed to maximize after-tax returns while ensuring full compliance with evolving regulations.

- Personalized Lending Solutions: Competitive, flexible credit facilities to support your business and personal endeavors.

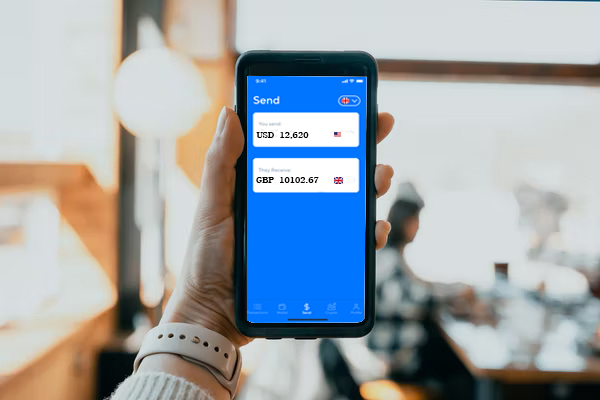

Real-Time Account Access

Advanced Security Protocols

User-Friendly Interface

At USFCU, your financial success is our top priority. We’re here to provide personalized guidance and support every step of the way. Before you contact us, please take a moment to review our services and consider how we can best serve your needs. We look forward to connecting with you soon.

FREQUENTLY ASKED QUESTIONS

What is USFCU Mobile Banking?

USFCU Mobile Banking is a secure and convenient way to manage your accounts on the go. With our mobile app, you can check balances, transfer funds, pay bills, and even deposit checks—all from your smartphone or tablet.

How Do I Enroll in USFCU Mobile Banking?

You can log in to your online banking account and select the mobile banking enrollment option. If you need help, our customer support team is available to guide you through the process.

How Secure is USFCU Mobile Banking?

At USFCU, security is a top priority. Our mobile banking platform uses advanced encryption, multi-factor authentication, and continuous monitoring to protect your financial information. We also recommend that you use strong passwords and update your app regularly for added security.

What is USFCU’s Private Banking Service?

USFCU’s Private Banking service is a personalized financial solution designed for members with significant assets. With dedicated relationship managers, bespoke investment strategies, and tailored wealth management advice, we work with you to help achieve your long-term financial goals.

Who Qualifies for USFCU’s Private Banking?

Our Private Banking services are typically designed for members who meet certain asset thresholds and are seeking a higher level of personalized financial management. If you’re interested in learning more about eligibility and how our private banking solutions can benefit you, please contact one of our financial advisors.

What Support Does USFCU Offer for Digital Banking Services?

USFCU is committed to providing exceptional support for all our digital banking services. Whether you have questions about our mobile app, need help troubleshooting online banking issues, or want to learn more about our private banking services, our knowledgeable support team is here to assist you via phone, email, or in-branch consultations.

TESTIMONIALS

Leave Us a Message

- +1 479-446-2533

- support@usfcuak.com

- West Markham Street, Little Rock | AR