ABOUT US

About Us

At the core of USFCU is a leadership team composed of industry veterans, financial experts, and visionary innovators. Our Board of Directors and executive management are dedicated to upholding the highest standards of corporate governance, ensuring that every decision is made with our clients’ best interests in mind.

We believe in a culture of transparency, accountability, and collaborative decision-making. Our leadership is not only responsible for steering the strategic direction of the bank but also for nurturing the values that have defined us for generations. From our day-to-day operations to long-term planning, every facet of our work is guided by a commitment to ethical practices, robust risk management, and an unwavering focus on client service.

Our Core Values and Philosophy

Our operating philosophy is simple: every client deserves bespoke financial solutions, delivered with integrity and precision. These principles underpin every aspect of our business:

- Client-Centric Approach: We build lasting relationships by understanding each client’s unique financial needs and aspirations.

- Ethical Stewardship: Every transaction, strategy, and recommendation is guided by our commitment to fairness, transparency, and ethical behavior.

- Innovation in Service: Embracing modern technology and forward-thinking strategies allows us to offer solutions that are both innovative and practical.

- Sustainable Growth: We focus on creating long-term value—both for our clients and for the communities we serve—by integrating sustainable practices into our business model.

Private Banking & Wealth Management

Our private banking services are tailored to high-net-worth individuals and families who demand a level of service that is both personal and unparalleled. We offer:

- Bespoke Wealth Management: Customized investment strategies developed by our seasoned advisors.

- Asset Protection & Estate Planning: Strategies to safeguard your legacy for future generations.

- Tax Optimization: Expert guidance designed to maximize after-tax returns while ensuring full compliance with evolving regulations.

- Personalized Lending Solutions: Competitive, flexible credit facilities to support your business and personal endeavors.

About Us

Our Story: The Genesis of a Legacy

USFCU was born out of a vision to provide unparalleled financial services with a human touch. Our journey began over a century ago when a group of forward-thinking entrepreneurs and community leaders sought to create an institution that would serve as a pillar of strength in an ever-changing economic landscape. From humble beginnings in a modest office, our founders envisioned a bank that not only safeguarded wealth but also nurtured the growth and prosperity of the communities it served.

In the early days, our focus was on building strong, personal relationships with our clients. We recognized that trust and transparency were essential to financial success, and every decision was made with the utmost consideration for the client’s well-being. As America entered eras of rapid industrialization, economic challenges, and technological transformation, USFCU evolved—always guided by our founding principles of integrity, excellence, and service.

A Century of Evolution and Excellence

Throughout our long and storied history, we have witnessed the evolution of banking from traditional ledger-keeping to the digital revolution. Our journey is marked by:

- Pioneering Initiatives: From introducing early forms of digital record keeping to establishing the first customer-centric online banking platforms, we have consistently led industry innovations.

- Resilience Through Change: Weathering financial crises, market volatility, and regulatory shifts, our unwavering commitment to our clients has seen us emerge stronger each time.

- A Culture of Continuous Improvement: Our dedication to research, education, and the professional development of our staff has ensured that we remain at the forefront of industry trends.

Each chapter in our history is a testament to our ability to adapt, innovate, and continue to serve with excellence. We honor our past by learning from it and using those lessons to shape a future that is as dynamic and responsive as the world around us.

Leadership and Governance

At the core of USFCU is a leadership team composed of industry veterans, financial experts, and visionary innovators. Our Board of Directors and executive management are dedicated to upholding the highest standards of corporate governance, ensuring that every decision is made with our clients’ best interests in mind.

We believe in a culture of transparency, accountability, and collaborative decision-making. Our leadership is not only responsible for steering the strategic direction of the bank but also for nurturing the values that have defined us for generations. From our day-to-day operations to long-term planning, every facet of our work is guided by a commitment to ethical practices, robust risk management, and an unwavering focus on client service.

Our Core Values and Philosophy

Our operating philosophy is simple: every client deserves bespoke financial solutions, delivered with integrity and precision. These principles underpin every aspect of our business:

- Client-Centric Approach: We build lasting relationships by understanding each client’s unique financial needs and aspirations.

- Ethical Stewardship: Every transaction, strategy, and recommendation is guided by our commitment to fairness, transparency, and ethical behavior.

- Innovation in Service: Embracing modern technology and forward-thinking strategies allows us to offer solutions that are both innovative and practical.

- Sustainable Growth: We focus on creating long-term value—both for our clients and for the communities we serve—by integrating sustainable practices into our business model.

Our core values not only define who we are but also chart the course for our future. They inspire us to continue evolving and to remain responsive to the ever-changing needs of our clientele.

Social Responsibility and Community Engagement

Beyond the balance sheets and boardrooms, USFCU takes immense pride in our role as a socially responsible institution. We believe that the true measure of success is not only in financial growth but also in the positive impact we have on our communities. Our initiatives include:

- Community Development Programs: Investing in local infrastructure, educational programs, and small business development projects to drive economic progress.

- Philanthropic Partnerships: Collaborating with charitable organizations and foundations to address critical issues ranging from healthcare to environmental conservation.

- Sustainable Banking Practices: Implementing eco-friendly operational practices and supporting green initiatives to promote a sustainable future.

- Financial Literacy Outreach: Hosting workshops and seminars that empower community members with the knowledge to make sound financial decisions.

Our commitment to social responsibility is woven into the fabric of our daily operations. It is our firm belief that a thriving community is the foundation upon which lasting financial prosperity is built.

Charting Our Future: Vision and Growth

As we look toward the horizon, USFCU remains steadfast in our mission to lead through innovation, dedication, and an unwavering commitment to our clients. Our future initiatives include:

- Expanding Global Reach: Strengthening our international partnerships to provide you with diversified investment opportunities and broader market access.

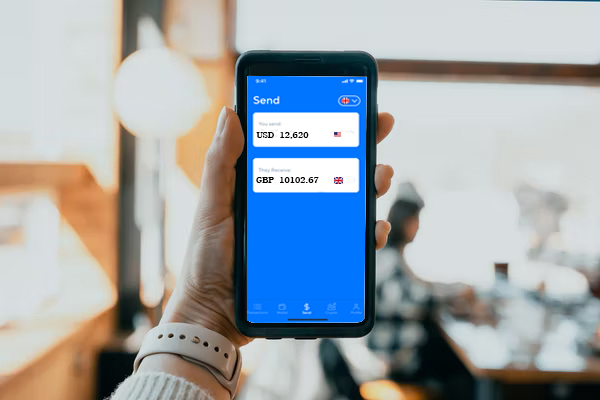

- Next-Generation Digital Platforms: Continually enhancing our online and mobile banking services, making secure financial management more accessible than ever.

- Tailored Wealth Solutions: Developing innovative products that cater to the evolving needs of high-net-worth individuals, families, and businesses.

- Sustainable Investment Practices: Integrating environmental, social, and governance (ESG) criteria into our investment strategies to promote responsible growth.

- Enhanced Customer Engagement: Leveraging advanced data analytics to offer a more personalized banking experience and anticipate the needs of our valued clientele.

Every step we take is driven by our belief in creating lasting value for our clients and our communities. We invite you to join us as we write the next chapter in a legacy defined by trust, innovation, and a relentless pursuit of excellence.

USFCU is more than a financial institution—it is a tradition of excellence, a promise of security, and a partner committed to your financial journey.

Innovation, Expertise, and Client Success

The success of USFCU is inextricably linked to our relentless pursuit of innovation. We continually invest in advanced technologies and research initiatives to ensure that our clients have access to:

- Cutting-Edge Investment Tools: Utilizing state-of-the-art analytics and risk management systems, we empower you to make informed, data-driven decisions.

- Personalized Financial Planning: Our expert advisors work one-on-one with you, crafting customized strategies that reflect your individual financial landscape.

- Global Market Intelligence: With a network of international partners and a team of market specialists, we bring global insights to your portfolio.

- Ongoing Client Education: From seminars and webinars to personalized consultations, we are committed to empowering our clients through continuous financial education.

We measure our success not by the volume of assets managed but by the quality of our client relationships. Every strategy we develop, every product we offer, and every innovation we pursue is aimed at fostering an environment where your financial success is our top priority.

At USFCU, your financial success is our top priority. We’re here to provide personalized guidance and support every step of the way. Before you contact us, please take a moment to review our services and consider how we can best serve your needs. We look forward to connecting with you soon.

FREQUENTLY ASKED QUESTIONS

What is USFCU Mobile Banking?

USFCU Mobile Banking is a secure and convenient way to manage your accounts on the go. With our mobile app, you can check balances, transfer funds, pay bills, and even deposit checks—all from your smartphone or tablet.

How Do I Enroll in USFCU Mobile Banking?

You can log in to your online banking account and select the mobile banking enrollment option. If you need help, our customer support team is available to guide you through the process.

How Secure is USFCU Mobile Banking?

At USFCU, security is a top priority. Our mobile banking platform uses advanced encryption, multi-factor authentication, and continuous monitoring to protect your financial information. We also recommend that you use strong passwords and update your app regularly for added security.

What is USFCU’s Private Banking Service?

USFCU’s Private Banking service is a personalized financial solution designed for members with significant assets. With dedicated relationship managers, bespoke investment strategies, and tailored wealth management advice, we work with you to help achieve your long-term financial goals.

Who Qualifies for USFCU’s Private Banking?

Our Private Banking services are typically designed for members who meet certain asset thresholds and are seeking a higher level of personalized financial management. If you’re interested in learning more about eligibility and how our private banking solutions can benefit you, please contact one of our financial advisors.

What Support Does USFCU Offer for Digital Banking Services?

USFCU is committed to providing exceptional support for all our digital banking services. Whether you have questions about our mobile app, need help troubleshooting online banking issues, or want to learn more about our private banking services, our knowledgeable support team is here to assist you via phone, email, or in-branch consultations.